Licensed Warehousing System in Turkey and Warehouse Receipts

Introduction

Producers can deliver the harvested products to "Agricultural Products Licensed Warehousing Enterprises" operating under the supervision of the Ministry of Commerce, instead of selling them at harvest time due to the low price caused by excess supply or for other reasons. Agricultural products delivered to licensed warehouses allow the products to be priced freely in the market and also establish price stability. Licensed warehousing also helps to keep the supply and demand of agricultural products in balance throughout the year. Producers may receive physically printed Warehouse Receipt(“WR”) or Electronic Warehouse Receipt (“ELÜS-Turkish” or “EWR”) in return for the products they deliver to licensed warehousing operators. The ELUS holder (with the legal definition “mudî-Turkish” or “depositor”) can take delivery of the product in the quality and quantity represented by the warehouse receipt from the licensed warehouse at any time and at the latest end of the storage period of the product. Electronic warehouse receipts provide many conveniences in being easily exchangeable, an investment and financing tool, and tax advantages.

1. Licensed Warehousing System and Its Advantages

According to the Agricultural Products Licensed Warehousing Law No. 5300 (“Law”), Licensed Warehouse means the facilities that provide the services of keeping agricultural products in healthy conditions and storing them for commercial purposes. The licensed warehousing operator undertakes to return the product of the same quantity and quality to the depositors who delivered the product to it at the end of the storage period.The depositor pays a fee to the warehouse operator under the tariff determined by the ministry for the product left in the licensed warehouse. The warehouse operator issues a warehouse receipt and delivers it to the depositor. WR can also be issued electronically. The depositor holding the warehouse receipt may receive the product in the warehouse partially or completely at the end of the warehouse period. Products not received by the storage deadline may be sold by the warehouse operator. The warehouse operator has a right of lien on the product regarding the unpaid warehouse fee.

Licensed Warehousing Enterprise operates as a joint-stock company established with a paid-in capital of at least 1 million Turkish Liras, according to the Law. Real persons who will establish a licensed warehousing company must not have been convicted of the crimes listed in Article 7 of the Law. The licensed warehouse operator pays five per thousand of its wage income to the Compensation Fund established by the ministry every year to cover the possible losses of the depositors. The warehouse operator is obliged to take out the insurances determined by the Ministry and to protect the products of the depositors against all kinds of risks and disasters. The law regulates that the beneficiary of this insurance will be the depositor. Licensed Warehouses cannot make any purchases, sales, pledges, etc., and cannot take any action to change the quality of the products, unless permitted by the Law or by the depositor. The authorized classification license, which should be included in the classification of the products to be placed in the licensed warehouse, is given separately from the warehouse license. Finally, due to the importance given to licensed warehousing system, all changes regarding the partnership structure, management authorizations and signing authorizations for issuing warehouse receipts are subject to the approval of the Ministry.

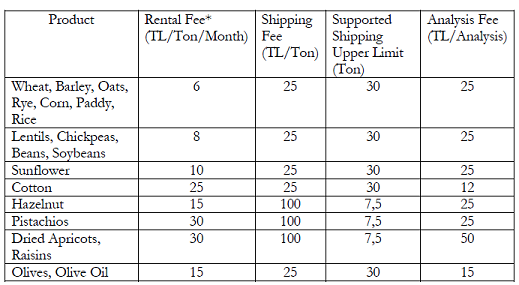

Accordingly to the Presidency's decision published in the Official Gazette dated 22.6.2021, support payments are made to the producers and producer organizations registered to TÜKAS/ÇKS in the amounts specified in the table below in return for the services they will receive from licensed warehousing operators:

(*) Producers registered to TÜKAS/ÇKS and producer organizations that place their products purchased from these producers and/or produced on their own behalf to be stored in licensed warehouse operators are provided with rent support for a maximum of six months in the amounts specified in the table for each production year, if they are the first to deliver.

2. Warehouse Receipts, Electronic Warehouse Receipts and Its Advantages

The depositor holding the warehouse receipt may receive the product, partially or completely, by presenting the product corresponding to the bill to the warehouse operator at the latest or before the end of the warehouse period. The operator who submits the receipt cancels the receipt by delivering the product. In case of partial delivery, the old receipt is canceled and a new receipt is issued and delivered to the depositor.

Warehouse receipts issued by licensed warehousing operators are traded on the stock exchange by the Turkish Product Specialization Exchange Joint Stock Company (“TURİB”). Agencies authorized by TURİB are commodity exchanges in the provinces. It is possible to trade as an investor in the TURİB by registering on these commodity exchanges and opening an investment account in a bank. Electronic warehouse receipts are traded in the same way as printed receipts. It is not possible to issue both printed and electronic warehouse receipt for the same product. Electronic warehouse receipts are produced by the warehouse operators through a secure electronic signature determined by the regulation. EWR may be subject to futures transactions on the stock exchange.

The depositor can evaluate the receipt as an investment tool, as a guarantee for the loans to be used, or by bartering in electronic exchanges, and negotiated by third parties. It is also possible to issue the receipt in a non-negotiable manner. The seizure of agricultural products attached to the warehouse receipt is made only by the seizure of the warehouse receipt.

Income from the sale of EWR is exempt from income tax and corporate tax until 31.12.2023. It should be noted that according to the VAT Law No. 3065, the delivery of the product represented by the product certificates to those who will pull it from the warehouse is included in the scope of VAT, at this point the VAT rate is 1%. In addition, the first delivery of product certificates to TURİB is within the scope of full exemption from VAT. The exchanges of EWR’s until the withdrawal of the products represented by EWR from the warehouse is within the scope of partial exemption according to subparagraph (t) of the fourth paragraph of Article 17 of the VAT Law No. 3065. EWR is also exempt from stamp duty, pursuant to Article 40 of the 488th Stamp Duty Law No.

Other prominent features of EWR’s are the ability to purchase and sell electronically without geographical boundaries, instead of product delivery, its affinity for the e-commerce sector, and the elimination of forgery of warehouse receipts.

Conclusion

Licensed warehousing systems are supported to spread the supply throughout the year, in order to prevent the problems that may occur in the food supply due to the adverse effects of disasters such as droughts and floods on the agricultural sector due to extreme climatic conditions, as well as the increasing population. As a result of this systems, the warehouse receipts given to depositors by warehouse operators appear as an alternative investment tool that can both activate the commercial life and meet the financing needs of the sector.

Yazar : Av. Yusuf Eren YILDIZ